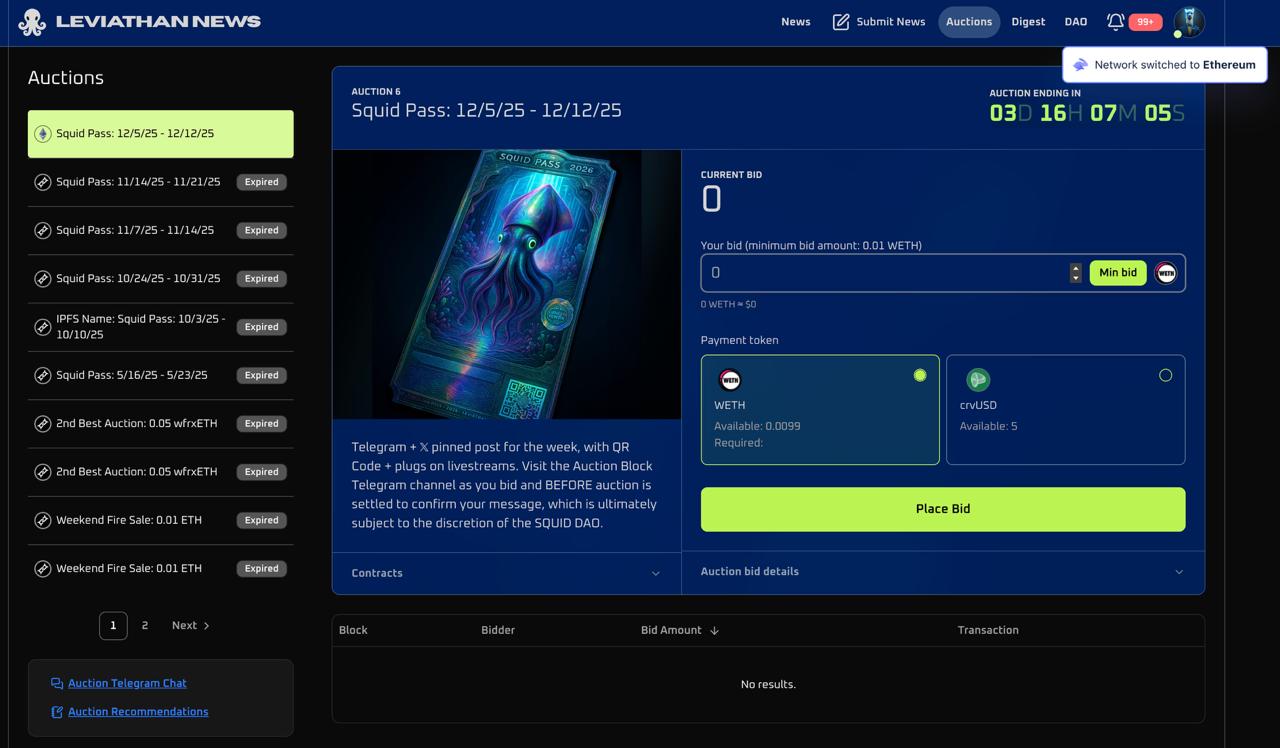

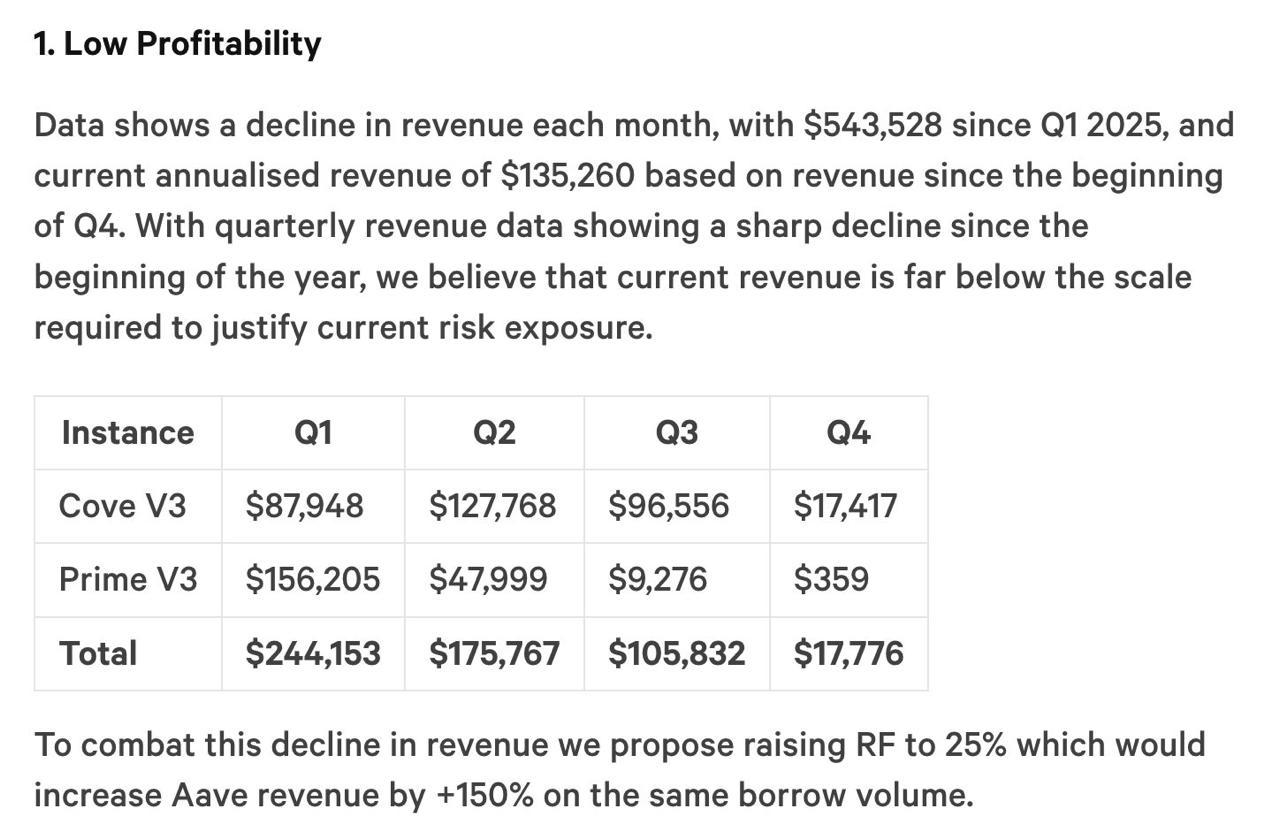

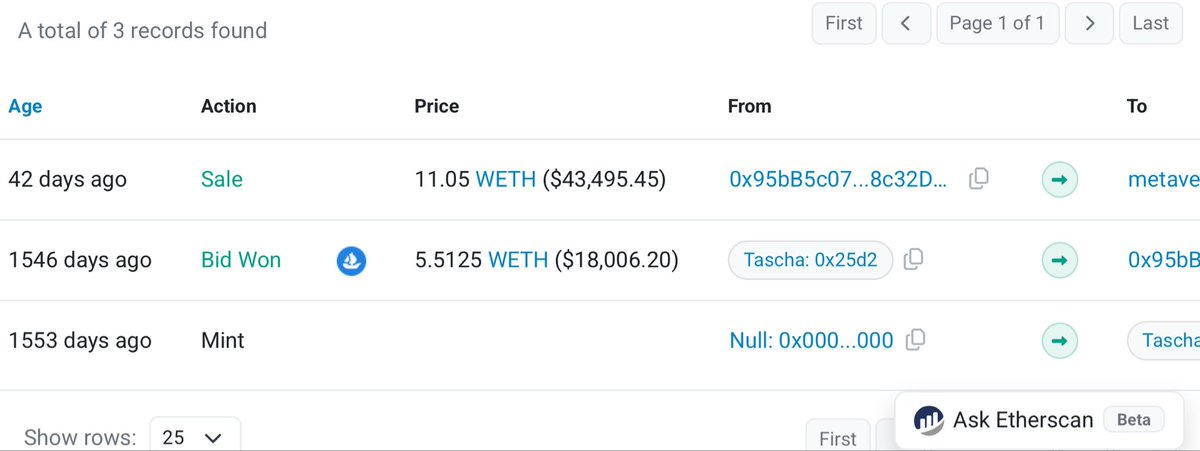

Hyperfinancialisation: On the rise and ouroboric nature of gambling and financialisation. This piece was written as an accompaniment to long degeneracy.

"In a hyperfinancialised economy, financial activities like speculative trading overshadow productive services which contribute more widely to society, while household wealth and inequality become increasingly tied to asset prices. to put it simply, wealth is no longer directly correlated to hard work and is disconnected from the means of production. this leads to more capital being channeled into speculative activities"